We believe in a multi-chain world, where different blockchains will specialize in servicing distinct clusters of use-cases. This development seems inevitable since there is no single best way of building a blockchain, as there are multiple architecture trade-offs, e.g. the “blockchain trilemma” on the consensus layer: the trade-off between security vs. scalability/speed vs. decentralization. In an earlier post, we discussed how the beginnings of a healthy DeFi ecosystem are starting to emerge on Polkadot.

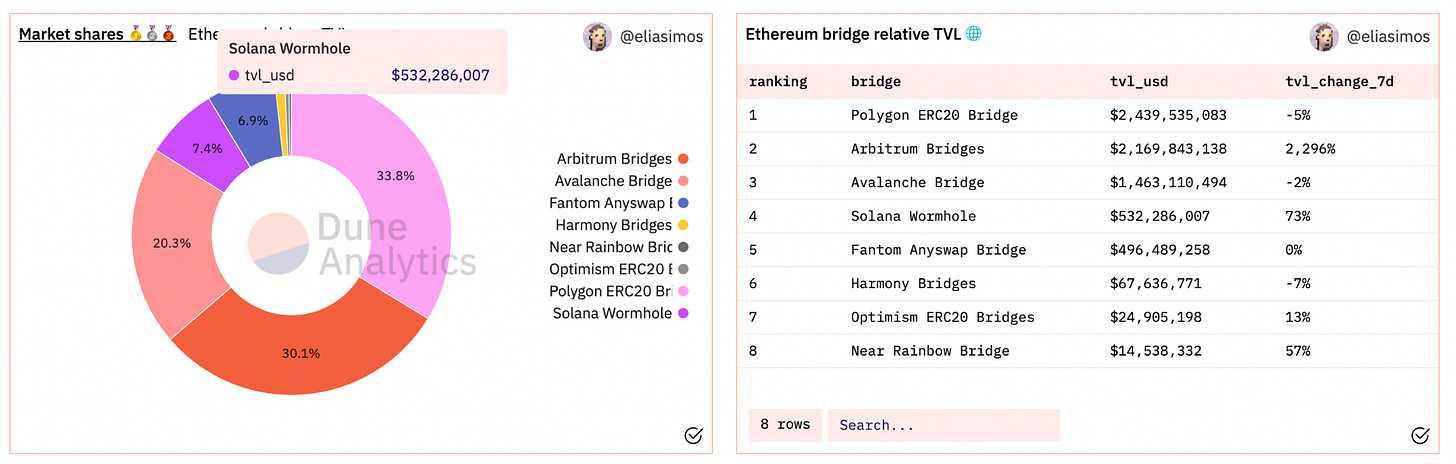

With a surging price of $SOL, Solana’s native token, and the promise for cheaper transactions, Solana has been increasingly talked about over the past months. Over the last week alone, the Solana Wormhole saw a 70+% increase in funds bridged from Ethereum.

Dune Analytics: Ethereum bridges dashboard by @elisasismos

Rather than using its increased scalability to build novel use-cases, the Solana community has been busy copying some of the major success stories on Ethereum (much to the chagrin of those projects). For example, SolPunks look so close to the originals on Ethereum that they can hardly even be called “derivative”. At first glance, it looks like the only difference is the Solana-colored background. Read more on the Solana-copycat phenomenon on Decrypt.

In order to differentiate effectively from Ethereum, copy-paste ecosystem development is not sufficient anymore for Solana.

Even though it makes sense to have basic DeFi infrastructure - from stablecoins to automated markets and leading protocols - just copying everything on Ethereum is not the way beyond that for upcoming blockchain ecosystems. Instead, blockchain ecosystems like Solana need to ask themselves what their comparative advantages are.

What applications are uniquely possible on or advantaged by this blockchain on a technical level?

What use-cases are most interesting to your community specifically on a social/cultural level?

We explore which use-cases might be uniquely suitable to be built on Solana, by looking at the technical specifications and advantages of the blockchain. We then think about what applications are enabled by the technical characteristics, what problems are resolved, and what specific use-cases could result from it.

According to their whitepaper, Solana’s increased throughput is made possible by using “Proof of History” to streamline block confirmations (see image above). Solana’s Gulf Stream system removes the need for a mempool by assigning transactions to a future block and forwarding them to validators before the previous block has finished being confirmed. Propagating transaction ordering before each block is created takes away that power from validators. Without the existence of a mempool, a large part of the front-running problems that plagued Ethereum disappear on Solana.

The technical advantages of Solana explored below are taken from this series of blog posts. We’re copying the 8 described technical innovations of Solana below as an overview but we recommend you check out the article itself for more context.

Proof of History (POH)— a clock before consensus;

Tower BFT — a PoH-optimized version of PBFT;

Turbine — a block propagation protocol;

Gulf Stream— Mempool-less transaction forwarding protocol;

Sealevel — Parallel smart contracts run-time;

Pipelining — a Transaction Processing Unit for validation optimization

Cloudbreak— Horizontally-Scaled Accounts Database; and

Archivers — Distributed ledger storage

From the technological analysis above, we identified three main areas that provide a significant comparative advantage for Solana over other blockchains: Scalability, parallel runtime, and proof-of-history.

Scalability

The most obvious advantage of Solana is that transactions are cheap and fast, and the blockchain is capable of managing an extremely high throughput. This is in stark contrast to Ethereum in its current state, where slow and expensive transactions are a significant hurdle for user adoption.

This positions Solana for applications that require high performance at low fees, for instance, applications that are aimed at mass audiences.

Another clear use-case is high-frequency trading on-chain. Given Solana’s cultural origin in the finance industry, it seems likely that one of the first use-cases to set Solana apart will be high-frequency trading (HFT). The linear time function and clear ordering of transactions provided by Proof of History further supports HFT.

Parallel runtime

Common blockchain virtual machines like EVM and WASM are single-threaded, meaning that only one contract at a time modifies the blockchain state. In contrast, Solana’s Sealevel supports parallel runtime, which can apparently process tens of thousands of contracts in parallel. Currently, parallel runtime is used in complex applications that are computation-intensive.

An example of a use-case enabled by parallel runtime is high-definition on-chain media: Imagine high-resolution dynamical artworks that can interact with objects on-chain. Another example would be social applications with complex interactions, potentially including NFTs.

Especially in combination with the scalability properties that might allow for more interaction with NFTs, we think Solana is uniquely positioned to bring the NFT space forward. There is hope that the ecosystem will move on from copying popular PFPs to Solana and start innovating.

Proof of History (POH)

One of the most difficult problems in distributed systems is agreement on time since block times are probabilistic only in most current systems. Hashing blocks together in Solana is done with a recursive verifiable delay function. Each node gets a cryptographic clock that produces a verifiable ordering of events as a function of time. Proof of History (POH) provides a historical record that proves that an event has occurred at a specific moment in time.

This advantage makes timestamping an attractive use case for Solana. Intellectual property systems and patenting on a blockchain would likely need such a reliable timestamping solution. In addition, there are many time dependencies in contracts, e.g. conditional transactions based on certain times (market opening hours, announcements) or time-bound restrictions. In this way, transactions could be scheduled in advance and be precisely executed at the selected time. In the future, Solana could abstract this capacity of creating a verifiable clock time in a distributed manner and could act as a clock time oracle for other blockchains and applications.

Another benefit of having a verifiable ordering of transactions upfront is that frontrunning on DEX is much harder (e.g. miners who slip in their own transactions before a profitable trade they see in the mempool). This again underlines the relevance of high-performance financial use-cases for Solana.

Solana ecosystem outlook

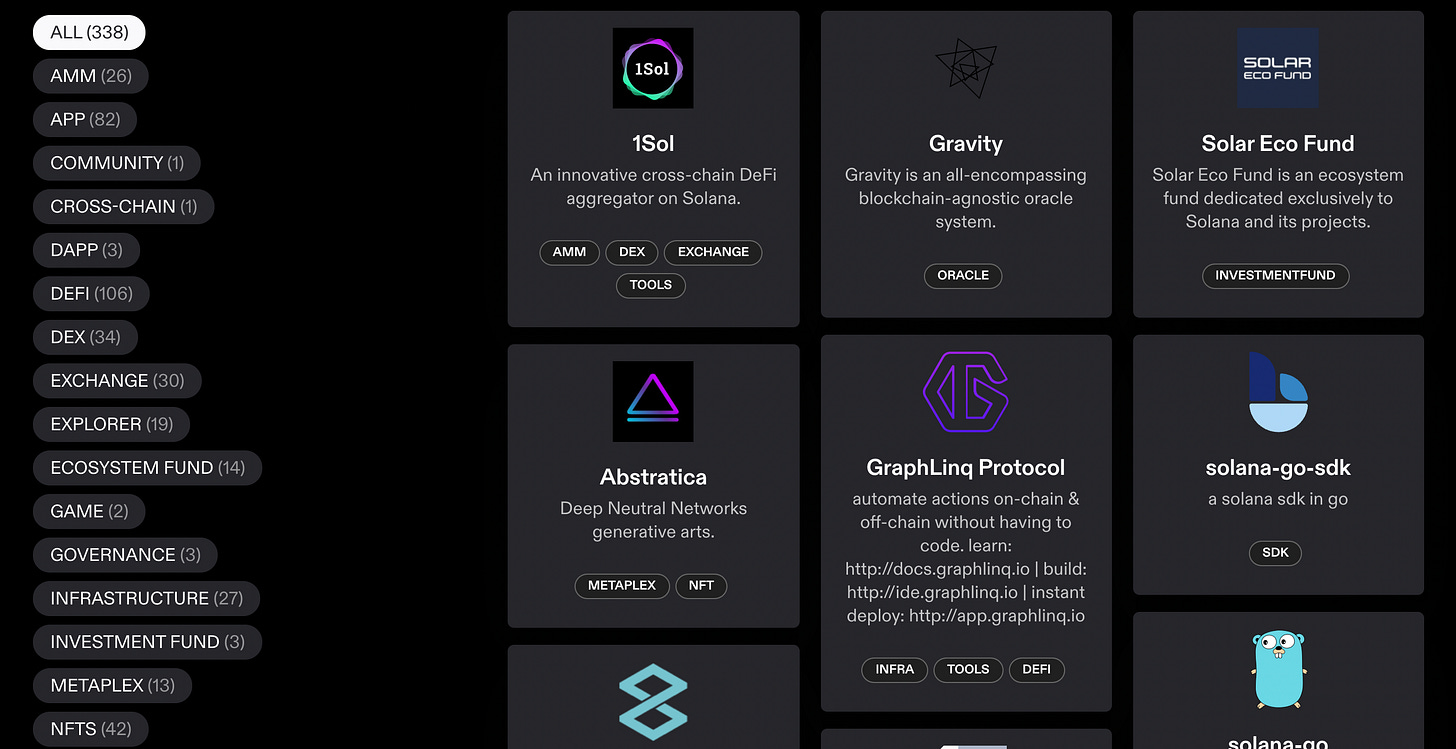

If we look at the current Solana ecosystem as presented on their website, we find the following state: A majority of use-cases is in the DeFi category, which makes sense especially for high-performance use-cases like high-frequency trading or next-generation DEX (where some problems like frontrunning are mitigated). DEX and exchanges come up as a category itself so that use-case with its unique advantages on Solana is definitely being pushed. The second-largest category is described as “App”, containing all sorts of applications that don’t neatly fit into another category. This is very encouraging from the perspective of creating new applications, not just copying existing ones on other blockchains. At last, we see that the NFT category is also developed more than others. As explored above, we think Solana could innovate thereby creating more interactive and social NFT experiences, as well as generating more complex and high-res art directly on-chain.

Even though DeFi and NFTs have emerged on Ethereum, it seems that Solana is uniquely positioned to push both of these use-cases further due to its high scalability and unique architecture. Over time, we would not be surprised if Solana was to focus on the long tail of high-intensity use-cases.